🔴 The TECHNICAL Tools of Negotiation:

From Theory to Practice

Last week, we explored how negotiation—or “deal-making”, as I personally prefer to call it—relies heavily on important communication components in order to be carried out successfully, in a balanced and mutually satisfactory way for both contracting parties.

Today, I want to focus on the technical aspects of deal-making which, in my view, are equally important and, in many cases, decisive in resolving seemingly irreconcilable differences.

The goal remains the same: to secure a signed sales contract or purchase order from the client. The difference, compared to the communication aspects, lies in the technical and operational preparation we must possess in order to propose—or counter-propose—alternative and acceptable solutions without compromising the essential guarantees we deem non-negotiable.

As with communication tools, when using technical tools, I am referring to win-win outcomes—solutions that are satisfactory to both parties.

However, in our roles as exporters, managers, salespeople, or consultants, our priority remains to close the deal—and if the negotiation shifts towards a win-lose scenario, it’s best that we end up as the winners!

Let us now look at some typical cases where negotiations become stuck due to demands that the other party considers unacceptable. And let’s also examine how

technical knowledge can unlock the situation—thanks to our ability to propose alternative solutions acceptable to both parties.

To be able to offer different technical solutions, one must have command of a wide range of legal and operational knowledge in the fields of International Shipping and International Payments.

Case 1:

We are negotiating with a new potential client. We know nothing about them and, prudently, we request 100% advance payment for the entire order.

The potential client replies that they cannot accept such terms, as it is too one-sided in our favour and exposes them to excessive risk—namely, the risk of not receiving the goods as agreed after having already made full payment.

The client proposes to pay upon arrival, after customs clearance and inspection of the goods. The positions of both parties are far apart and appear irreconcilable.

Our counter-proposal no. 1:

We suggest the use of a Standby Letter of Credit, which—thanks to its dual nature as both a bank guarantee and a documentary credit—offers the importer a guarantee of delivery, and the exporter a guarantee of payment. In this way, we remove the buyer’s objection and significantly increase the chances of successfully closing the deal.

Our counter-proposal no. 2:

We request a 30% advance payment (or another percentage sufficient to cover at least the production cost), with the remaining 70% to be paid by a Sight Letter of Credit confirmed by a leading bank.

This solution provides sufficient guarantees to both parties. The importer knows the exporter will certainly ship the goods in order to receive the remaining 70%, while the exporter already has cost coverage at the time of shipment and is assured of receiving the balance upon presenting the required documents to the bank.

This counter-proposal, offering balanced guarantees to both buyer and seller, also has excellent chances of success.

Case 2:

We are negotiating with a new potential client. We know nothing about them and prudently request 30% advance payment for the order.

The client replies that such a condition exposes them to the risk of not receiving the goods as agreed after making the initial payment.

Our counter-proposal:

We ask our bank to issue an Advance Payment Bond in favour of the foreign buyer. This guarantee ensures full reimbursement of the amount paid in advance in the event of seller default—that is, if the exporter fails to ship the goods.

This solution eliminates the risk of non-delivery for the buyer, while satisfying our request for partial advance payment, thus removing a major obstacle in the negotiation.

Case 3:

We’ve decided to open a new market. To increase competitiveness, we approach wholesalers in the target country directly, bypassing local importers.

Wholesalers are interested in our products but, not being “importers”—and therefore not administratively or customs-prepared to buy from foreign suppliers—they reject our offers.

Our counter-proposal:

Thanks to our knowledge of Incoterms, we consult with our trusted freight forwarder and decide to offer DDP (Delivered Duty Paid) terms to the foreign client. This allows the client to receive our goods already customs-cleared and delivered to their warehouse, as if supplied by a local importer—but at a significantly lower price.

This solution requires careful execution but opens up access to a vast market of wholesalers and large retailers that would otherwise be unreachable.

Case 4:

We are in negotiation with a new potential client and request payment via a Sight Letter of Credit confirmed by a leading bank.

The client refuses this method, claiming it exposes them to the risk of receiving non-conforming goods.

Our counter-proposal:

While the Letter of Credit is the most advanced form of international payment, we know that the seller is paid upon presentation of complete and compliant documentation to the bank. However, despite the correct documentation, the goods could still be non-conforming—a concern fully understood by the buyer.

To eliminate the buyer’s objection, we propose to include a Certificate of Inspection amongst the required documents under the Letter of Credit.

This certificate, issued by specialised inspection companies (such as SGS - Société Générale de Surveillance, with 2,600 offices worldwide), guarantees that the goods conform to the contractual specifications.

The bank confirms the documentation in the exporter’s country, while the inspection certificate ensures the goods match the order. Without this certificate, the documentation would be incomplete and insufficient for the exporter to receive payment. Adding this document provides the importer with enough assurance to overcome their concern. The deal can then proceed to a successful conclusion.

Case 5:

We act as international intermediaries and have the opportunity to purchase goods and resell them to a foreign buyer on a regular basis. However, we face two main issues:

We lack the funds to purchase the goods in the required quantity.

We fear being bypassed in the deal after the first shipment.

Possible solution:

We ask the foreign buyer to pay by Transferable Letter of Credit, naming us as the first beneficiary. We then designate our supplier as the second beneficiary. We know that the Transferable Letter of Credit allows us to:

Purchase goods without using our own funds.

Replace the supplier’s invoice with our own and appear as the order originator to the supplier—preventing the foreign buyer and the Italian supplier from discovering each other’s identities.

Thanks to our knowledge of available payment methods and how to use them in practice, we have resolved two issues that would otherwise have prevented us from earning the expected profit.

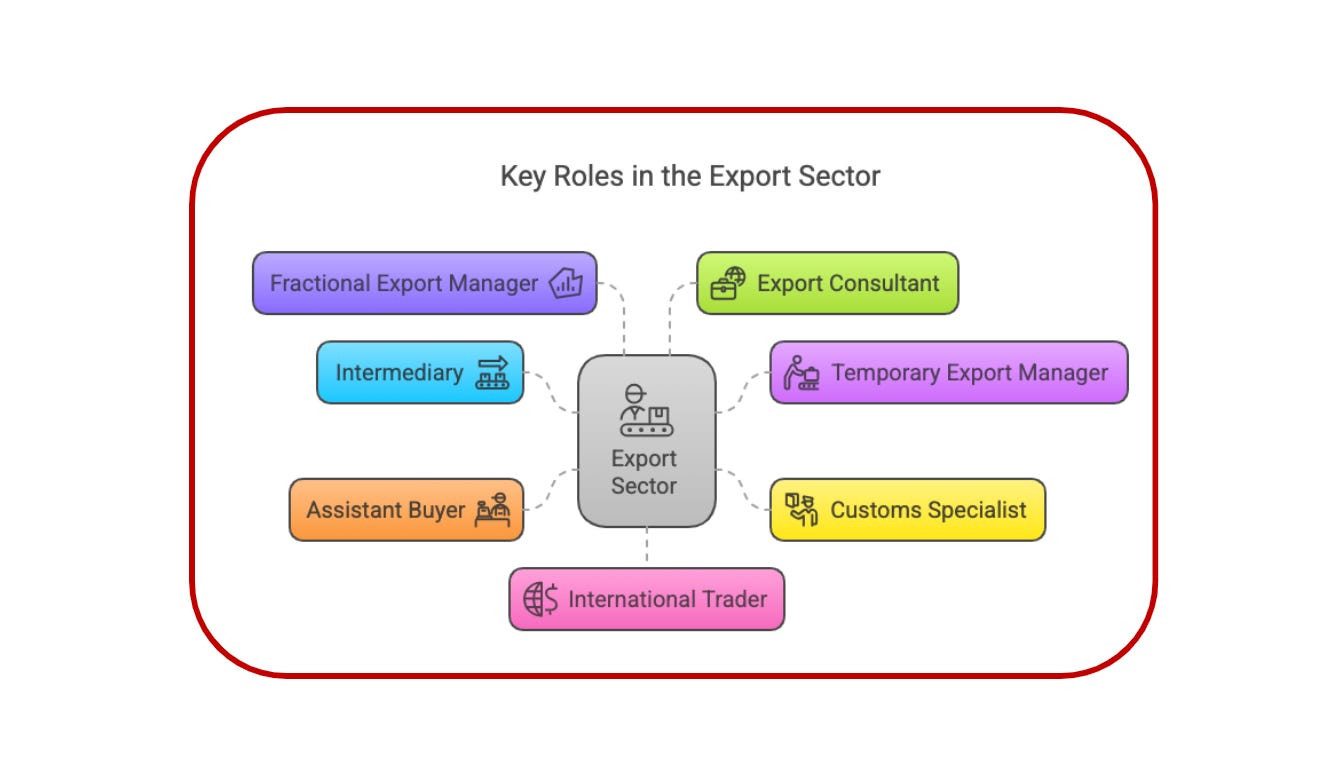

Anyone working in export must master two essential areas of expertise:

International Shipping

International Payments

To which we may add, where necessary, the organisation (or reorganisation) of the export department. But this body of knowledge requires more than simple learning—it demands a commitment to transforming information into practical tools and operational procedures that help us achieve our professional and financial goals.