🔴 Incoterms® DAP

The most versatile term of delivery

The Incoterms® 2020 rules are the latest revision of the international trade terms published by the International Chamber of Commerce (ICC). They are internationally recognised as The most authoritative and effective way to allocate transport costs and risks between the seller and the buyer in an international sale of goods.

The Incoterms® 2020 rules determine whether the seller or buyer is responsible for, and must bear the cost of, specific tasks that are part of the international carriage of goods. Furthermore, they indicate when the costs of carriage and the risk of loss of or damage to the goods pass from the seller to the buyer.

In this article, we examine the DAP Incoterm, which stands for “Delivered At Place” (followed by the indication of the place of delivery).

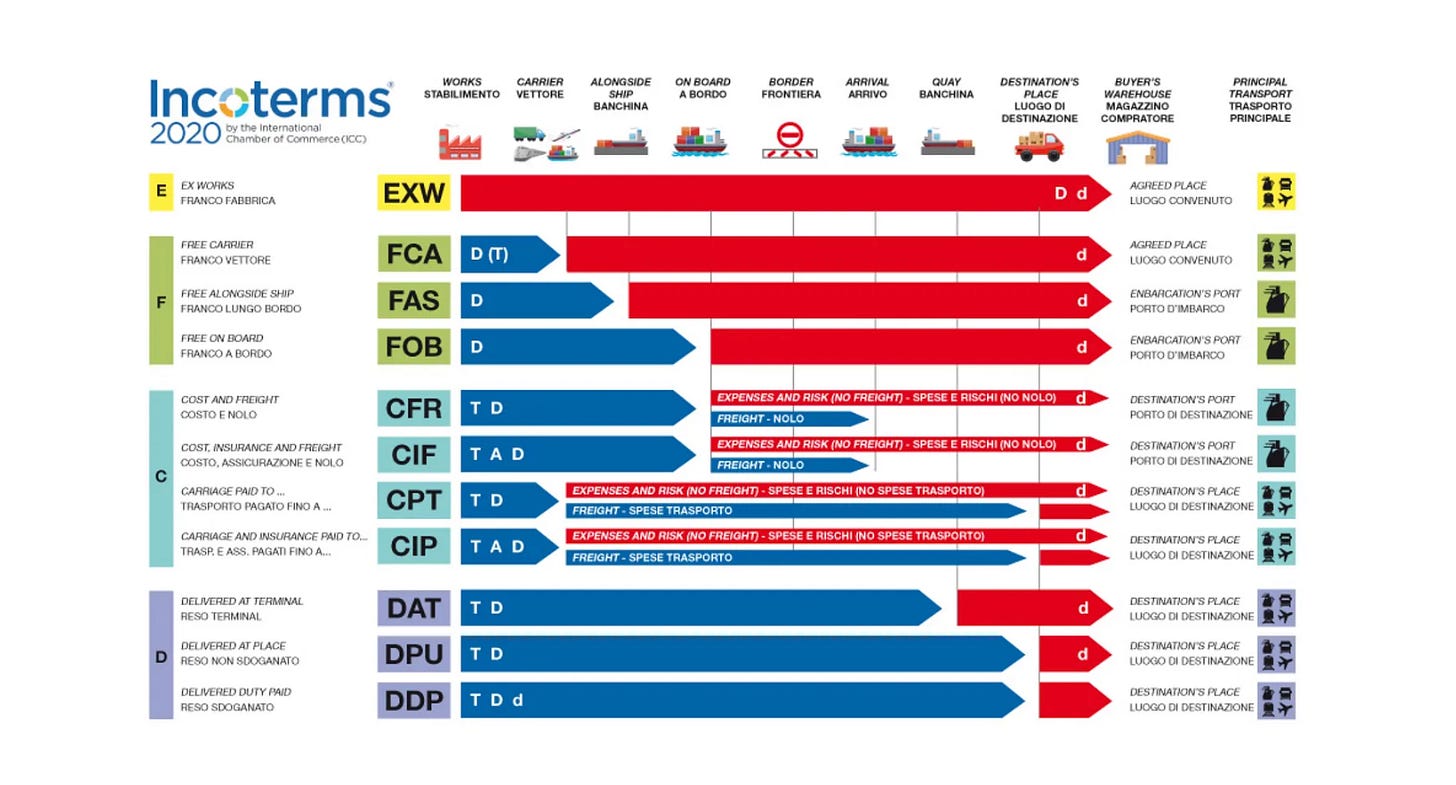

The trade terms developed by the International Chamber of Commerce are 11 in number and are conventionally listed from Ex Works (EXW), which imposes minimum obligations and risk on the seller, to Delivered Duty Paid (DDP), which places maximum obligations and risk on the seller. The Incoterms® 2020 Table of Responsibilities and Risk Transfer (shown above) summarises the responsibilities of the seller and the buyer under each of the 11 terms.

Responsibilities and Risks under “Delivered At Place” (DAP)

According to the Incoterms® 2020 rules, the DAP term means that the seller is responsible for all costs and risks involved in bringing the goods to the named place of destination, at which point the risk transfers to the buyer.

The transfer of costs and risks from the seller to the buyer occurs simultaneously when the goods are made available for unloading.

The buyer is responsible for all costs and risks associated with unloading the goods and clearing the goods for import in the country of destination of the shipment.

The importer delegates the import customs clearance to their customs broker and is responsible for import customs duty, taxes, any applicable charges, and also storage costs if the goods are not cleared in a timely manner.

It is always advisable for the seller to coordinate with the buyer's customs broker to provide all necessary documentation for import customs clearance.

Transport Options for the “Delivered At Place” (DAP) term

The International Chamber of Commerce has divided the 11 Incoterms® into those that can be used for any mode of transport and those that should be used only for "sea and inland waterway transport". According to the Incoterms® 2020, the DAP term can be used for any mode of transport. Furthermore, DAP is ideal for use in multimodal transport, i.e., for the type of transport involving the use of different modes.

Using “Delivered At Place” (DAP)

When using the DAP term, it is important that the buyer and seller precisely identify the place of destination, because both risk and cost transfer from the seller to the buyer exactly at this place.

The DAP term is the most flexible term of delivery: the named destination can be a port, an airport, the buyer's premises, or a border crossing. It does not necessarily have to be the final destination of the shipment;

any place mentioned in the DAP term is acceptable as long as it is a foreign destination or a border crossing.

The DAP term may seem similar to CPT, but this flexibility is one of the main differences. The other difference is that under DAP, the risk of loss of or damage to the goods remains with the seller until the goods arrive at the named place. Whereas under CPT, this risk is borne by the foreign buyer.

Under this Incoterm, the seller is required to make the goods available for unloading but is not required to unload them at the place of destination.

In some cases, the cost of carriage borne by the seller also includes the cost of unloading at destination. These costs cannot be charged to the buyer, unless otherwise agreed.

Questions and Answers (FAQs)

What are the risks for the buyer when using DAP?

Buyers using DAP are responsible for unloading the goods at the named place of destination and for handling import customs formalities. They must ensure they have the necessary resources: an accredited customs broker to manage import procedures, the payment of customs duty, taxes, and any potential storage or demurrage charges if the goods are not cleared promptly.

Can sellers choose DAP instead of DDP to reduce risks?

Yes, sellers who wish to avoid the complexities and risks associated with customs duties and import taxes often prefer DAP to DDP. By choosing DAP, sellers retain control over the transport but transfer responsibility for customs clearance to the buyer.

Which party is responsible for insurance under DAP?

Under DAP, the seller is not obliged to provide insurance coverage for the goods. In any case, it is advisable for both parties to agree on insurance cover to protect against loss or damage during transit.

Is DAP suitable for all types of shipments?

DAP is ideal for multimodal transport but can be used for any mode of transport.

Is DAP suitable for both international and domestic shipments?

All Incoterms, including DAP, are primarily used for international trade, but there is no reason why Incoterms® cannot also be used for a domestic shipment, provided both parties agree on the use of the chosen term. Naturally, if used domestically, certain responsibilities, such as handling customs formalities, are simply disregarded because they are not applicable.

Who is responsible for customs clearance under DAP?

Under DAP, it is stipulated that the seller handles export customs formalities while the buyer must handle import customs formalities, bearing all related costs.

Can the buyer request additional services or modifications with DAP?

DAP defines the minimum responsibilities and obligations of the seller and the buyer. Any additional services or modifications beyond these terms can be negotiated between the buyer and seller. It is important to clearly mention any agreements or requirements not covered by the term of delivery in the contract of sale to avoid misunderstandings or misinterpretations.